Lazy_Bear/iStock via Getty Images

U.S. stocks closed down for the week.

Last week, the stock market rose for the first time in eight weeks, giving investors a little breather.

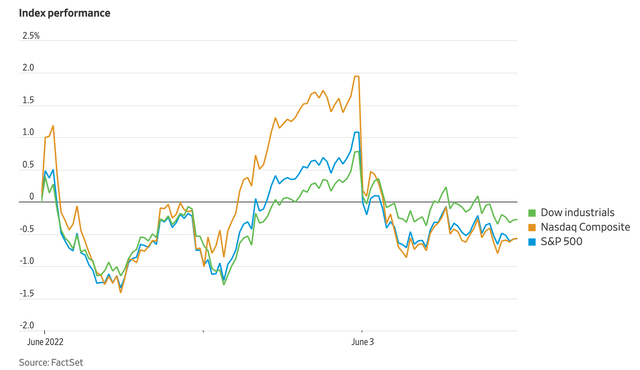

This week, well, the S&P 500 Stock Index was down by 1.6 percent, the Dow Jones Industrial Average fell 1.00 percent, and the NASDAQ Composite dropped 2.5 percent.

Stock Market Performance (Wall Street Journal)

In all, the week was a relatively stable one, with only a “bounce” coming in the middle of the week.

The good news for the week: U.S. employers added 390,000 jobs last month. This was the slowest rate of growth since April 2021, but was above expectations.

Wages grew 5.2 percent from last May, but this was down from 5.5 percent a month earlier.

So, with this being the “good news”, it also contributes to the “bad” news.

The U.S. economy and the U.S. labor market are showing enough strength that the Federal Reserve System has enough justification to continue its push to fight the inflation in the economy.

The Federal Reserve “Plan”

This Federal Reserve effort was clarified a bit more this week as Federal Reserve officials released information on how it plans to reduce its securities portfolio.

So, for right now, the Fed is planning to begin to reduce the size of its securities portfolio this June and continue to let securities mature off its balance sheet until the middle of 2025.

The Fed’s plan will take the Fed’s securities portfolio from its current level of $8.9 trillion to something around $6.0 trillion at the latter date.

The reduction effort will depend solely upon the securities maturing off of the Fed’s balance sheet.

So, the Fed will lose about 1/3 of its securities portfolio over the next three years.

Interest rates will rise.

For now, it looks like the Fed’s policy rate of interest, the Federal Funds rate, will be in the 2.25 percent to 2.50 percent range sometime this September.

So, the stock market, which has depended upon Federal Reserve support to hit more and more new historical highs through the past year, will not have the Fed’s support going forward.

The S&P 500 Index hit its last historical high on January 3, 2022.

The trend has been downwards since then.

The big question is still the Federal Reserve itself. Just how steady will the Fed be with respect to reducing the size of its securities portfolio if the stock market is taking a substantial hit.

Chairman Jerome Powell, since he has been the head of the Fed, has always acted to err on the side of monetary ease. Investors are concerned that he will continue to do so in the future if the stock market or financial institutions begin to act in too fragile of a manner.

The Other Question: The Value Of The U.S. Dollar

Another issue has gained attention over the past week or so.

The value of the U.S. dollar has risen into a range that analysts are asking whether or not the dollar will come into parity with, for example, the Euro or the British Pound.

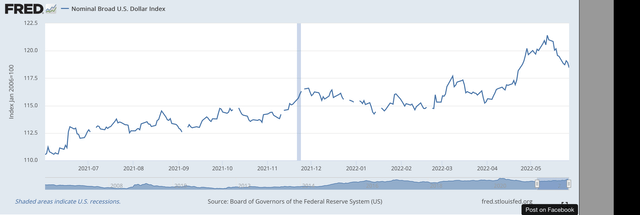

For the past year, the value of the dollar has risen rather steadily as the actions of the Federal Reserve impressed investors that the Fed’s monetary policy would become tighter and remain tighter than most of the world’s central banks, especially the European Central Bank and the Bank of England.

Here is an index of the value of the U.S. dollar since June 1, 2021.

Dollar Index (Federal Reserve)

Here is the U.S. dollar/Euro exchange rate over the same time period.

Dollar/Euro Exchange Rate (Federal Reserve)

The exchange rate closed on Friday with the Euro costing $1.0722. The rate has been as low as $1.0375 on May 12, 2022.

So, some analysts are talking about the Euro costing only $1.0000 in the near future.

Problem: What does a strong dollar do to U.S. companies?

Well, it is not good.

Matt Grossman writes in the Wall Street Journal:

“Microsoft Corp. (MSFT) on Thursday cut its sales and earnings guidance, citing the U.S. dollar’s gains in the foreign-exchange markets.”

Microsoft gets most of its profits from outside the United States.

“In the latest fiscal year, the company’s pretax foreign income was $36.1 billion, compared with $35.0 billion domestically.”

“That outsize share of international business means that a strengthening dollar weighs on the company’s operations.”

“Microsoft Chief Financial Officer Amy Hood told analysts that in the latest fiscal quarter, foreign-exchange effects reduced the company’s sales by $302 million.”

Other companies are starting to talk about the same thing.

The question then becomes, have investors built into stock prices the impact that a strong and rising dollar will have on U.S. corporate profits?

The guess is that this exchange rate effect has not been fully anticipated.

One More Thing

So, we have just one more thing that may impact future stock prices.

And, again, the environment becomes more complex.

Stock markets will remain volatile, and the basic tendency will be for the stock market to fall.

The next shoe to drop is the Fed’s efforts to shrink its securities portfolio.

from WordPress https://ift.tt/8y2P9tf

via IFTTT

No comments:

Post a Comment