Ultima_Gaina/iStock via Getty Images

The bear market rally may be ending as stocks get ready to dump again. The patterns in the market seem to be on a repeat cycle from a technical and fundamental standpoint. The recent move lower in rates may have only been temporary, and now that they are on the rise, it may lead to the dollar breaking out. If the dollar breaks out, then the equity market rally will be dead.

A strong dollar has been another factor in the stock market’s weakness, as a stronger dollar impacts multinational companies’ sales and earnings. The dollar is on the move on June 28 and potentially breaking out. That is likely to result in the stock market taking another leg lower very soon.

Patterns Persist

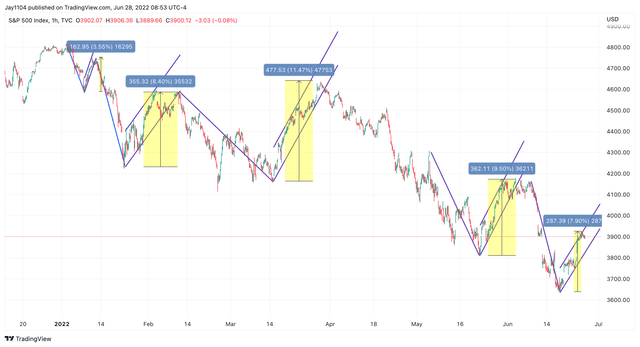

Since the beginning of 2022, the S&P 500 has seen consistent sell-offs, followed by sharp and steep rallies. The rallies have been in the 8% to 12% range in just a few days. However, they tend to fade fast, and once the rising technical trading channel breaks, the rally melts.

The most recent rally following the June option expiration date has been just as sharp and quick as the previous rallies. It is likely to fail just like the others.

TradingView

Blame The Dollar

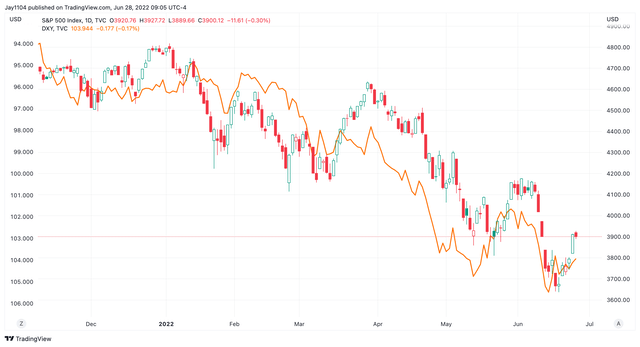

The equity market rally is likely to fail because rates are now in the process of breaking out again, as noted in a write-up on June 27. On top of that, the dollar now appears to be breaking out due to higher rates. The dollar is often underrated regarding its impacts on the equity markets, with interest rates taking much of the glory. But the dollar has been just as impactful on the equity markets this year. After all, a stronger dollar negatively impacts the rate of global growth, as commodities, goods, and services priced in dollars abroad become more expensive in foreign markets. It also hurts international businesses, reducing sales and earnings potential.

An inverted chart of the dollar index overlayed with the S&P 500 shows how the ups and downs in the dollar index have negatively impacted the S&P 500. If the dollar is beginning to strengthen once again, then it seems reasonable to believe that the equity market is on the cusp of its next leg lower.

TradingView

Technical Trends

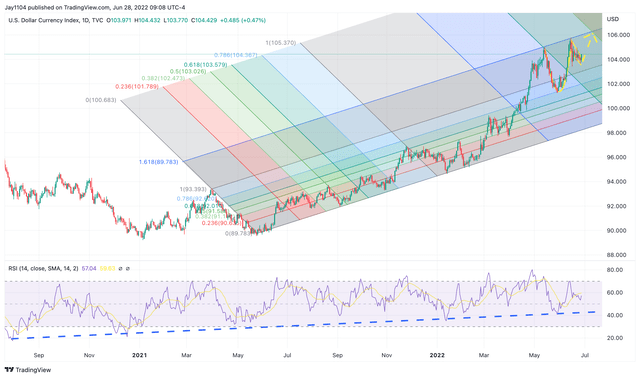

A dollar index chart shows that a bullish pattern called a cup and handle is present. A cup and handle is a bullish continuation pattern and suggests the potential for the dollar index to rally to around 106 or higher. Momentum in the dollar index is strong, with an RSI trending higher since July 2020.

TradingView

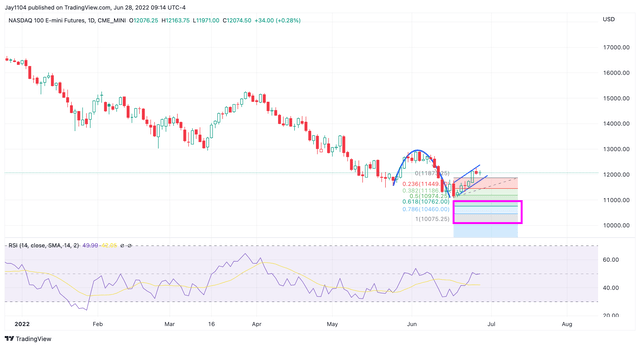

A chart of the NASDAQ 100 futures shows an inverted cup and handle is present, which is a bearish continuation pattern. A projection of that pattern would suggest that NASDAQ 100 futures drop to 10,100 to 10,750. However, the futures would need to fall below 11,800 to confirm such a bearish outcome is possible.

TradingView

If all of this plays out and the dollar begins to push higher, as noted, along with yields, it seems pretty likely that the bear market rally in equities is over, and the indexes will be on the way to making new lows in the not too distant future.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

from WordPress https://ift.tt/kDRiF2w

via IFTTT

No comments:

Post a Comment